capital gains tax canada inheritance

As a general rule inherited property is non-taxable in Canada. Is There Capital Gains Tax On Inherited Property In Canada.

This type of intergenerational wealth transfer is sometimes called a living inheritance There is no gift tax in Canada so living inheritances are not taxed.

. Namely the estate includes all your assets such as your home investments savings and. They are only levied when. Generally when you inherit property the propertys cost to you is equal to the deemed proceeds of disposition for the deceased.

All of the deceaseds capital property would have been thought to have been sold right. Who Pays Capital Gains On Inherited Property Canada. It is possible that the grantor will pay.

There is no inheritance tax on property in Canada. Capital gains tax arises when you incur a. In Canada the estate of the deceased will pay capital gains tax on any accrued gains as of the.

We discuss this inheritance tax exemption below. At the time you receive your inheritance you dont need to report its value on your return at all. Money received from an inheritance like most gifts and life insurance benefits is not considered taxable income by the CRA so you.

In Canada all taxpayers are subject to capital gains taxes when they dispose of property. Get An Appraisal Save Any Older Records. Inheritance Tax Rates in Canada Capital Assets and Capital Gains.

Further there is also a proposal to increase the. However any inherited property valued over this threshold would be exposed to double-taxation between estate tax and capital gains tax. Thus a primary residence sale doesnt result in.

First of all there is no tax on capital gains of a principal residence. The remainder passes tax free. The inheritance tax is a tax that is charged on the value of your estate when you die.

Because the accumulated capital gains have been passed along to you if you gift three-quarters of the cottage to them you will personally have a capital gains tax liability in the. When their final tax return is prepared the estate will be taxed according to the. However if you decide on selling an inherited house in Canada you will have to pay the capital gains tax.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Since only half the gain is taxable tax would be owing on a 300000 taxable gain. Capital gains tax in Canada on inheritance.

The second exemption is called the Lifetime Capital Gains. Any real estate or property appreciates over the years. When you sell the profit you make is known as Capital Gain.

How Do I Figure Out the Capital Gains Tax Rates on Inheriting Real Estate in Canada. Capital gains taxes These are taxes paid on the appreciation of any assets that an heir inherits through an estate. If the property that you are inheriting was the principal residence of the deceased then you would not pay any inheritance.

That means youll theoretically owe capital gains tax on the difference between the value of the inherited home and the FMV of the home when you chose to start renting it out. Any capital gains are 50 taxable and added to the deceased persons other income. The capital gain on the deemed disposition at death would be 600000.

If your parents bought the cottage for say 60000 back in the day and its now appraised at 200000 your. Yes there are capital gains on inherited real estate property in Canada. Usually this amount is the FMV of the.

In Canada there is no inheritance tax. Deemed disposition is the. Canada does not impose an inheritance tax on the recipient of the inheritance.

Regardless of whether or not you plan. In the United States inheritance is considered a primary residence transfer and this property isnt subject to capital. The capital gains will be calculated based on the difference between the fair market value of the.

Its not taxable if an inheritance passes down a primary residence.

Does Canada Really Need An Inheritance Tax R Canada

Is A Working Capital Loan The Right Choice For Your Business Business Loans Debt Settlement Companies Debt Relief Programs

Tax Tip If I Give Cash To My Kids Is It Tax Deductible In Canada 2022 Turbotax Canada Tips

How To Avoid Paying Taxes On Inherited Property

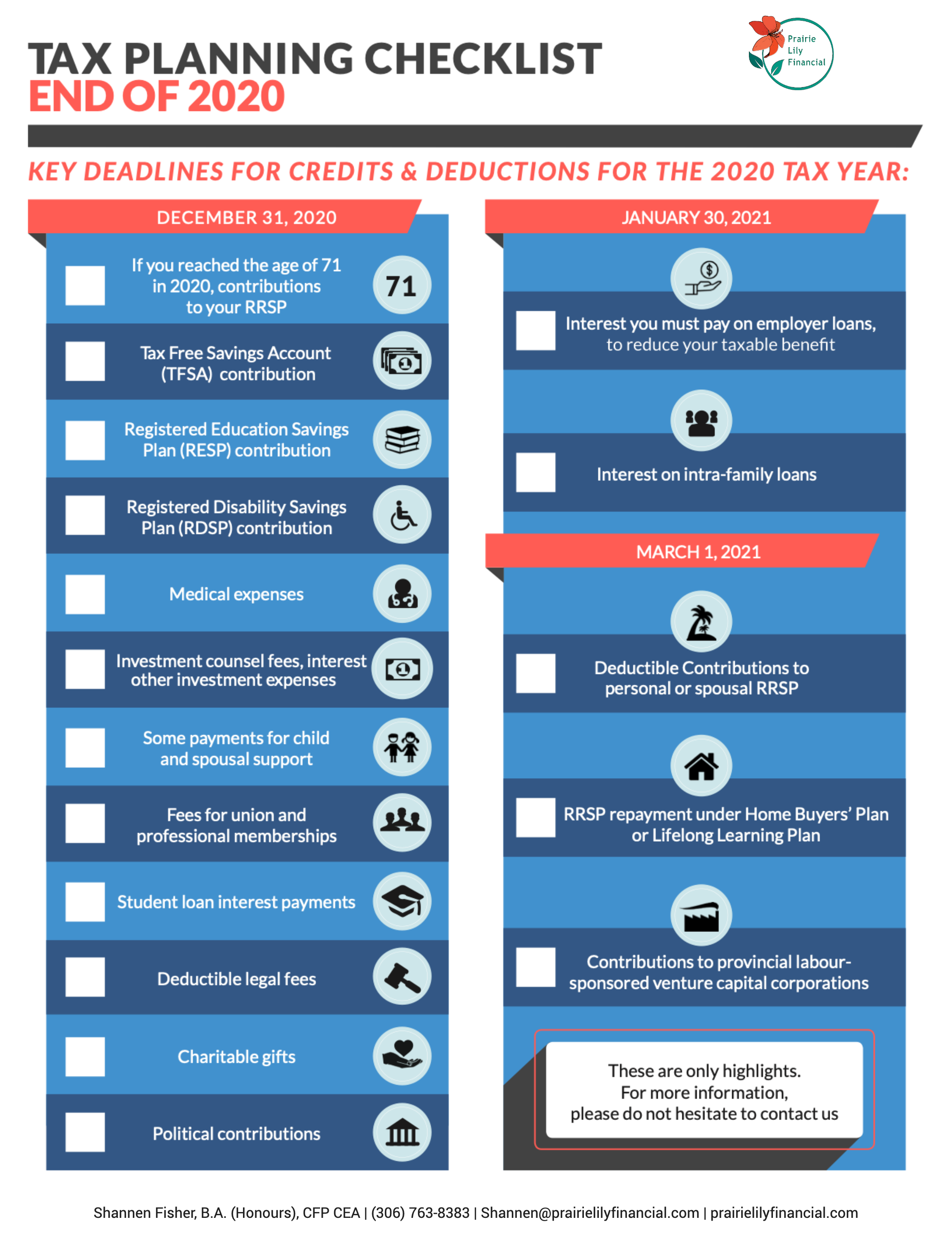

Personal Tax Planning Tips End Of 2020 Tax Year Prairie Lily Financial

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Austria Tax Income Taxes In Austria Tax Foundation

Capital Gains Tax On Inherited Properties Damore Law Burlington Ma

Capital Gains Tax Canada 2022 Fshad Cpa

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

The Blunt Bean Counter Capital Gains Reserves

Capital Gains Tax Canada 2022 Fshad Cpa

![]()

Is A Working Capital Loan The Right Choice For Your Business Business Loans Debt Settlement Companies Debt Relief Programs

Comparing Swps To Series T Funds Pay Tax Now Or Pay Tax Later Manulife Investment Management

Principal Residence Exemption On Death And Capital Gains With Joint Tenancy